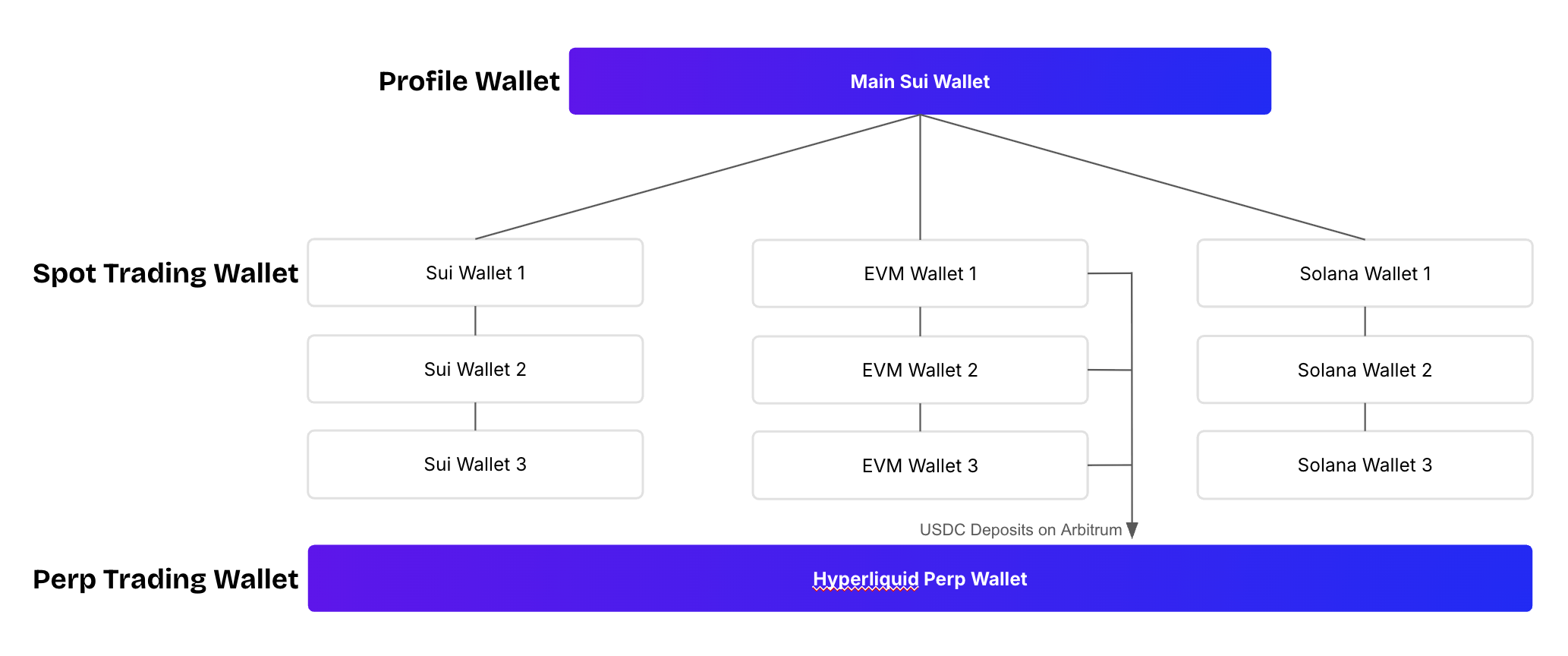

QuantHive Wallet Breakdown

QuantHive’s main profile wallet is based on the Sui blockchain, serving as the central hub for your account and rewards. Users can link up to three trading wallets from each supported chain, EVM, Sui, and Solana to their Sui profile wallet.

EVM wallets linked can be used for depositing USDC on Arbitrum into the Hyperliquid perpetual wallet for trading perps, while all linked wallets support spot trading.

Trading activity from all connected wallets is tracked and contributes to the referral program and point farming, ensuring seamless integration across chains and maximizing user benefits.

Last updated