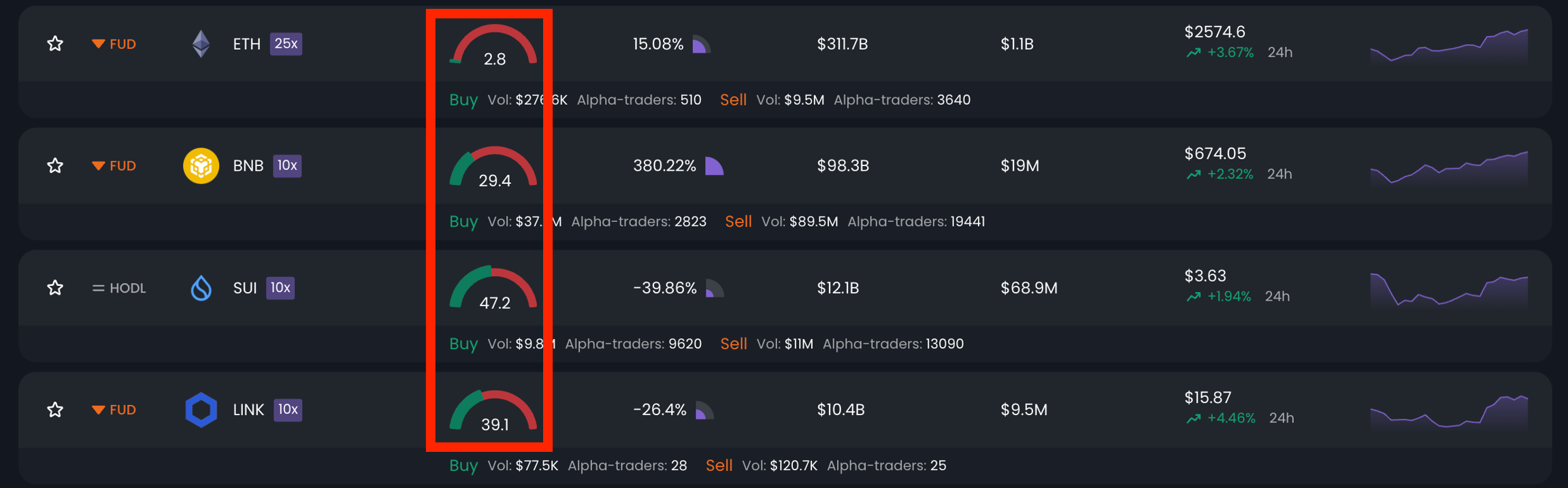

Traders' Profitability Index (TPI)

The Traders' Profitability Index (TPI) is a proprietary metric developed by QuantHive to help traders quickly assess the confidence and positioning of top-performing on-chain wallets, also known as Alpha Traders, for any given token.

Rather than relying on short-term P&L snapshots, TPI is derived from an extensive analysis of wallet behavior over their entire trading history, ensuring that only consistently profitable wallets (top 2%) are considered. This eliminates noise from lucky wins or fluke trades and focuses on sustained trading performance.

How TPI Works

TPI is calculated by comparing the buy vs sell volume from Alpha Traders for a particular token. A higher TPI score indicates strong buy-side activity, suggesting these elite wallets are accumulating the token. A lower score reflects increased selling activity, implying reduced conviction or distribution.

TPI Score Range: 0 to 100

55+: Strong accumulation (high buy volume)

45–55: Mixed or neutral sentiment

<45: Distribution (higher sell volume)

TPI is updated in real-time, ensuring traders can catch shifts in sentiment as they happen.

Why TPI Matters

True Alpha Filtering: Only trades from the most consistently profitable wallets are included.

Clear Signal Strength: A simple numerical scale lets you quickly understand market behavior.

Noise Reduction: TPI focuses on volume from wallets with proven track records, not speculative short-term activity.

TPI is your alpha radar, giving you a unique look at what the top 2% of on-chain traders are doing. Use it to time entries, avoid traps, and sharpen your edge in both spot and perp markets.

Last updated