Architecture Overview

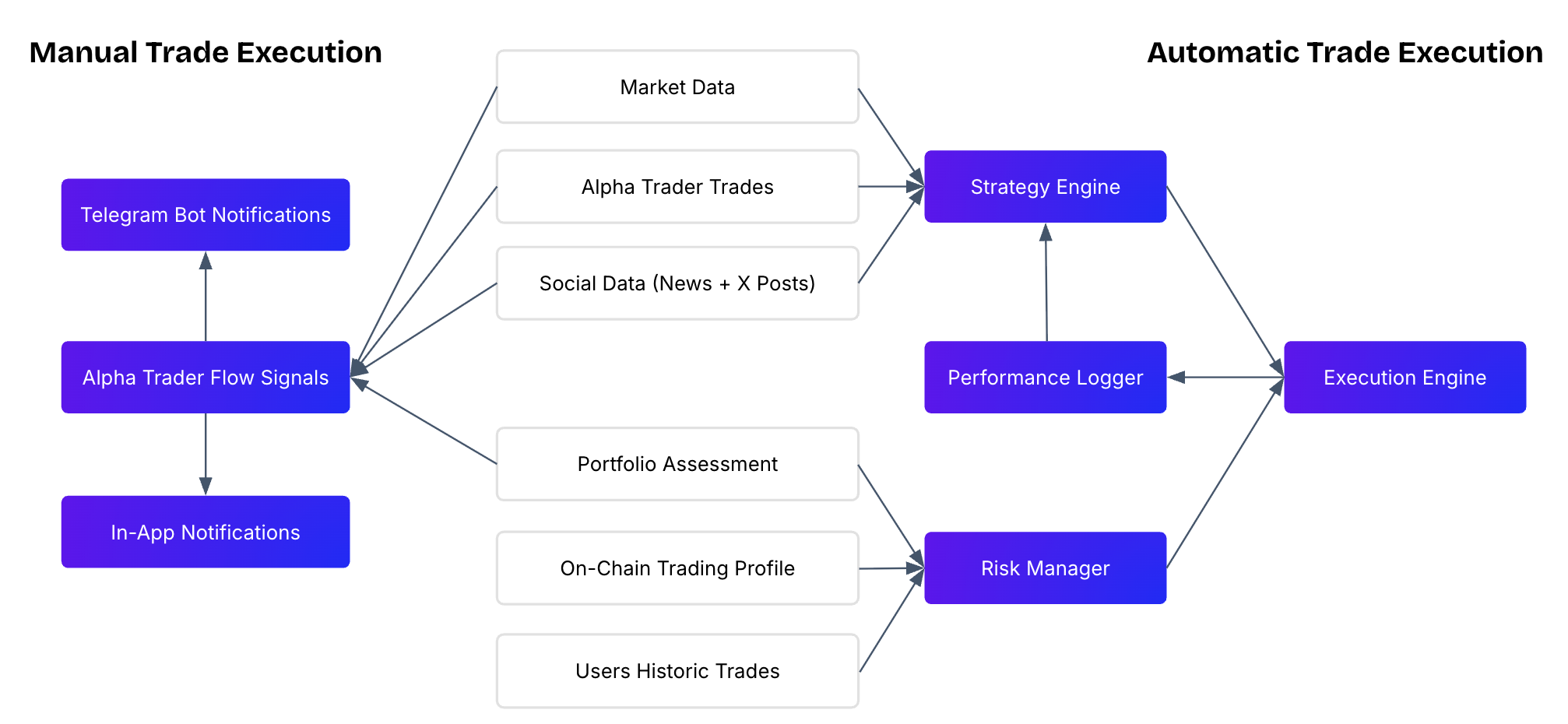

QuantHive’s architecture is designed to support both manual and automated trade execution, giving users full control or full automation based on their preferences. Users can manually act on real-time trading signals generated from aggregated alpha trader wallet activity.

For those who prefer hands-off trading, QuantHive offers automated trade execution, where the platform uses AI models trained on users’ on-chain profiles and watchlist behavior to execute trades on their behalf. Both modes are powered by our omni-chain infrastructure, allowing seamless execution across EVM, Sui, and Solana networks.

Last updated